Obama aide Axelrod says banking industry must step up lending to struggling businesses

By APMonday, December 14, 2009

Axelrod: Obama to lecture banks on accountability

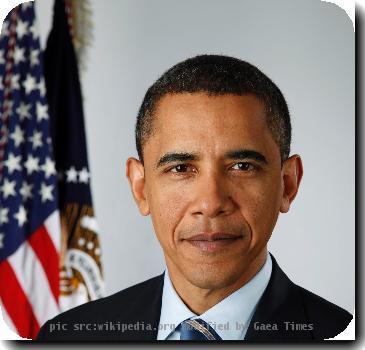

WASHINGTON — A top adviser to President Barack Obama says the White House is telling the banking industry it helped create last year’s near economic meltdown and it has to be “part of the solution.”

Previewing a meeting Obama will have later Monday with industry leaders, David Axelrod said there simply has to be easier credit for businesses to reinvest and do the hiring needed to bring down double-digit unemployment.

Interviewed on ABC’s “Good Morning America,” Axelrod said the message to bankers is: “You have to accelerate lending to credible small businesses.” He spoke a day after Obama, in an interview CBS’s “60 Minutes,” said he didn’t run for president to “be helping out a bunch of fat cat bankers.”

THIS IS A BREAKING NEWS UPDATE. Check back soon for further information. AP’s earlier story is below.

WASHINGTON (AP) — President Barack Obama is asking bank executives to support his efforts to tighten the financial industry, while bankers are prepared to tell the president he should stop oversimplifying their concerns if he wants good-faith collaboration.

An hourlong meeting between the president and the nation’s top financial firms was shaping up to be a tense White House encounter on Monday, not least because of Obama’s description of bankers on the eve of the talks as “fat cats.”

Administration officials described the meeting as a continuation of discussions the president initiated early in his tenure and the latest push for lenders to take greater responsibility as the nation combats an economic crisis that began on Wall Street.

Specifically: Wall Street should fall in line with Obama and back a proposal for a consumer protection agency that cleared the House last week.

“I did not run for office to be helping out a bunch of fat cat bankers on Wall Street,” Obama told CBS’s “60 Minutes” in an interview that broadcast Sunday.

Financial industry officials braced for Obama’s tough tone. They planned to press a conciliatory message and highlight areas where they agree with the administration while smoothing over their differences.

But the executives also planned to stand up to the president on issues where they feel his statements oversimplify their positions — particularly the creation of the Consumer Financial Protection Agency — according to people familiar with their thinking who spoke anonymously because they were not authorized to discuss the plans.

“He can say what he wants, but we’re not going to go back to the kind of lending that put us in this mess,” said a person who is helping prepare executives for the meeting. A dozen executives were on the list of those coming, from Goldman Sachs Group Inc., Bank of New York Mellon Corp., Bank of America Corp., Citigroup Inc., U.S. Bancorp , JPMorgan Chase & Co., Morgan Stanley and more.

Bankers expected the regulatory overhaul to provide the meeting’s most contentious moments. They believe the president has mischaracterized them as being against the new rules, when in fact they support the vast majority of the administration’s proposals.

“These same banks who benefited from taxpayer assistance … are fighting tooth and nail with their lobbyists up on Capitol Hill, fighting against financial regulatory control,” Obama said in the “60 Minutes” interview.

One industry official said Obama is viewed as trying to paint the debate as either “You’re with us or you’re against us.” The industry official said bankers did not view it that simply.

“We want him to know we have the same goals, but disagree about how to get there,” the official said.

Bankers were planning to outline alternatives to the new consumer agency. Most lenders support strengthened consumer protections but believe the administration proposal would increase costs and create more gaps between regulators.

Administration officials said Obama would use a populist appeal when discussing pay for top executives at bailed-out institutions. Distaste for Wall Street remains high and Obama took a public shot at the banks in his interview.

“They’re still puzzled why it is that people are mad at the banks,” he said. “Well, let’s see. You guys are drawing down 10, 20 million dollar bonuses after America went through the worst economic year … in decades and you guys caused the problem.”

Many firms have taken steps toward the administration’s goals of tying pay to long-term performance and making sure companies do not encourage risky bets. Bowing to public outrage, Goldman Sachs Group Inc. announced Thursday that 30 top executives will receive long-term stock instead of cash for bonuses this year.

Other banks, including Citigroup Inc. and Bank of America Corp., are overhauling pay structures to focus on long-term success.

Bank officials contend they would be hurt competitively by strict pay limits, such as the 50 percent tax on bonuses that British officials approved last week.

Obama economic adviser Lawrence Summers said Sunday the president would have “a serious talk with the bankers.

“The country did incredible things for the banking industry,” he said. “The bankers need to recognize that. They need to recognize that they’ve got obligations to the country after all that’s been done for them, and there is a lot more they can do.”

Summers spoke on ABC’s “This Week.”

Tags: Barack Obama, North America, Personnel, Tv News, United States, Washington