White House encouraged by China’s flexibility on currency but keeps an eye on implementation

By Martin Crutsinger, APMonday, June 21, 2010

White House monitoring China’s currency promises

WASHINGTON — The White House is encouraged by China’s promise to allow flexibility in its exchange rate but believes the real test will be how well the pledge is enacted, administration officials said Monday.

China on Monday began following through on its commitment to let its currency appreciate, following charges that the yuan has long been undervalued. The change could help U.S. manufacturers by making their products more competitive in China.

White House spokesman Bill Burton said “we’re obviously encouraged” but added the administration is monitoring the implementation.

Burton said currency will still be a topic at the G-20 summit of wealthy and developing nations in Canada this weekend. He said leaders are striving for a durable economic recovery and “currency will certainly be a part of that discussion.”

At a separate briefing, a senior administration official said that China’s action was extremely important and had changed the dynamic for this weekend’s economic summit.

This official, who briefed reporters under ground rules that did not permit use of his name, said that China had alerted the administration before it made its announcement on Saturday that it planned to allow its currency to resume rising in value against the dollar.

After China’s central bank announced Saturday that it planned to introduce more flexibility into the management of its currency, the government allowed the yuan to rise to a record high against the dollar. In trading Monday, it took 6.7971 yuan to buy $1, an increase in the yuan’s strength of 0.4 percent from Friday when it required 6.8272 yuan to buy one dollar.

The yuan had been trading in a narrow range around 6.83 yuan to $1 since mid-2008 when the Chinese government abruptly halted an earlier period of allowing its currency to appreciate against the dollar out of concerns that the stronger yuan was hurting Chinese exports at a time of a global recession.

Wall Street initially rallied in trading Monday. But the Dow Jones industrial average ended the day down about 8 points after investors concluded that Beijing’s currency shift would produce gradual change and not offer much of an immediate boost to the U.S. economy.

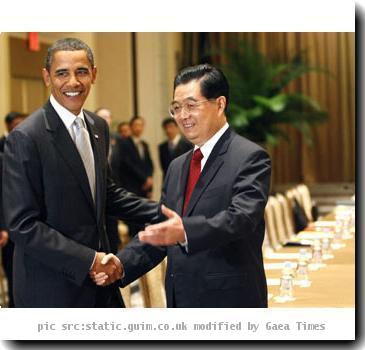

The U.S. official briefing reporters said the administration had urged the government of President Hu Jintao to take this step to avoid having China’s currency be a dominant point of debate at the economic meetings, which begin Friday and run through Sunday.

This official said the other major event in the runup to the summit was the announcement last week by European countries that they planned to subject their largest banks to stress tests to determine whether they would be able to deal with possible significant loan losses stemming from the debt problems faced by Greece and other European nations.

Obama wrote a letter to the other G-20 leaders on Friday in which he urged them to not pull back their efforts to stimulate their economies too quickly and run the risk of derailing the current recovery. The administration has been concerned that deficit cutting plans in Germany, France and Britain could remove stimulus too quickly.

The administration official, however, sought to play down those concerns at Monday’s briefing. He said the administration was no longer worried that nations were contemplating deficit reductions that would be damaging to the global recovery.

He said that major nations including the United States were still providing significant amounts of government stimulus, in the form of increased spending and tax cuts currently, and that it was only in 2011 and 2012 that deficit reduction would become more dominant. That will be at a time when most economists expect the global recovery will be self-sustaining.

Associated Press Writers Ben Feller and Tom Raum contributed to this report.

Tags: Asia, China, District Of Columbia, East Asia, Greater China, Hu Jintao, North America, Summits, United States, Washington