In spite of cuts to spending proposals, GOP senators may still block more jobless benefits

By Andrew Taylor, APWednesday, June 23, 2010

GOP senators may still block more jobless benefits

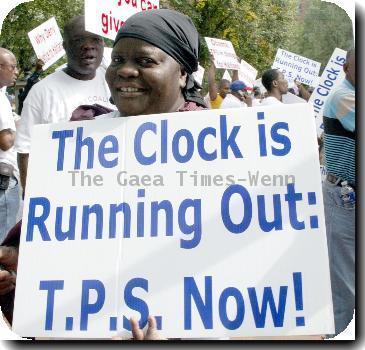

WASHINGTON — A Republican filibuster appears increasingly likely to kill long-sought legislation extending jobless benefits and a host of other spending and tax measures, despite a new round of cuts to the measure Wednesday that reduced its deficit impact even further.

A senior Senate Democratic aide said Wednesday evening that several days’ worth of negotiations with a handful of moderate Republicans had failed and that a vote later this week to break the filibuster was likely to fail as well. Democrats would then abandon the measure. The aide required anonymity to speak frankly about internal party deliberations.

Failure to pass the bill would mean about 200,000 jobless people a week would lose benefits that average more than $300 a week because they would be unable to reapply for additional tiers of benefits enacted since 2008. Governors denied help with their budget woes are likely to lay off tens of thousands of state workers.

A new version was offered Wednesday night by Majority Leader Harry Reid and would cut about $8 billion from a state aid package dearly sought by the nation’s governors and almost $2 billion in recissions of unspent stimulus and defense money.

The grab-bag measure would extend unemployment benefits, provide cash assistance to state governments and extend dozens of tax breaks sought by business lobbyists. It includes disaster aid, $1 billion for a youth summer jobs initiative and an extension of a bond program that subsidizes interest costs for state and local infrastructure projects.

Reid, D-Nev., had been courting Maine Republicans Susan Collins and Olympia Snowe to provide the critical votes needed to defeat a GOP filibuster, and the two senators were pressing for additional cuts to the measure.

The pared-back measure would add about $36 billion to the deficit over the upcoming decade, according to preliminary estimates, which is the cost of extending unemployment for the long-term jobless. When the debate started three weeks ago, Reid pressed a version that would have added almost $80 billion to the deficit.

But Snowe and Collins were withholding support, however.

“It’s clear that a great deal of progress has been made and I’m pleased with that,” Collins told reporters.

“They’re responding to some of the issues. We just haven’t finalized anything,” Snowe said.

The measure includes many items popular with lawmakers in both parties, including several items considered as must-do, including the further extension of unemployment insurance for people who have been out of work for more than six months, reversing a 21 percent fee cut imposed last week on doctors particpating in Medicare and renewing dozens of tax cuts.

They include a property tax deduction for people who don’t itemize, lucrative credits that help businesses finance research and develop new products, and a sales tax deduction that mainly helps people in states without income taxes.

A new version of the Senate measure began circulating Wednesday afternoon that pares back a $24 billion state aid package down to $16 billion and cuts $1.8 billion in previously appropriated money from stimulus and defense accounts, among other changes. A cut in food stamp benefits enacted last year appears to produce almost $10 billion in savings. It would cut the benefit for a family of four by about $45 a month when implemented in 2015, according to the Center of Budget and Policy Priorities, a liberal-leaning research and advocacy group.

There’s also $1 billion raised through noncontroversial reforms to a tax credit earned by the working poor.

The bill has bedeviled Democratic leaders for months. It’s become more difficult to pass as concerns about the deficit have bled GOP support since a similar bill passed more than three months ago. That measure was partially financed by relatively painless provisions including one enjoyed by paper companies that get a credit from burning “black liquor,” a pulp-making byproduct, as if it were an alternative fuel.

But that provision was used to help finance the massive health care overhaul. Democrats spent weeks coming to agreement on more controversial ways to replace the lost revenue, which include a new tax on investment fund managers and reforms aimed at small businesses that shelter income as dividends exempt from payroll taxes.

Deficit pressures are being felt in the House as well, where Democratic leaders are pressing a $7 billion cut in President Barack Obama’s budget for the next fiscal year.

Democratic aides said Wednesday that the cuts will be implemented as Democrats pass a short-term budget plan cutting deeper than Obama’s proposed freeze of the annual operating budgets of domestic agencies.

The cut amounts to less than 1 percent of the more than $1.1 trillion proposed for agency budgets funded by lawmakers each year through the spending bills. The next fiscal year begins Oct. 1.

The aides spoke on condition of anonymity because the plan has not been formally announced.

Majority Leader Steny Hoyer, D-Md., said Tuesday that the House won’t pass a longer term budget plan, a move that was met with scorn by Republicans, who charge Democrats with abdicating a basic responsibility of governing and of failing to have any plan to deal with the deficit.

The Maryland Democrat says that job should be left to Obama’s fiscal commission. But the decision against passing a budget frees Democrats from having to cast politically painful votes for huge budget deficits.

Tags: Barack Obama, Filibusters, Labor Economy, North America, Political Organizations, Political Parties, United States, Washington