After reviewing the current policy on buyback/prepayment of Foreign Currency Convertible Bonds (FCCBs), the Reserve Bank in consultation with the Government of India, has decided to extend the time limit for buyback of FCCBs issued by Indian companies up to March 31, 2012 at reduced discount rates. Accordingly, Indian companies have been permitted to buyback the FCCBs at a minimum discount of 8 per cent on the book value utilizing their foreign currency funds under the automatic route. Indian companies may also buyback the FCCBs at a minimum discount between 10 and 20 per cent on the book value utilizing their internal accruals under the approval route. Detailed instructions have been issued vide A.P. (DIR Series) Circular No. 75 dated June 30, 2011 (www.rbi.org.in/scripts/NotificationUser.aspx?Id=6490&Mode=0) .

It has come to the notice of Reserve Bank of India that some entity, which may be a foreign one, is operating in India and doing NBFI business, including acceptance of deposits, without obtaining a certificate of Registration (CoR) from RBI. The company is misusing the name of RBI by displaying a fake CoR on its web site for collecting deposits from the public.

Data on sectoral deployment of credit collected on a monthly basis from select 47 scheduled commercial banks accounting for about 95 per cent of the total non-food credit deployed by all scheduled commercial banks for the month of May 2011 are set out in Statements I (rbidocs.rbi.org.in/rdocs/content/DOCs/SDP300611ST_1.xls) and II (rbidocs.rbi.org.in/rdocs/content/DOCs/SDP300611ST_2.xls) . These data are also available in the Real-Time Handbook of Statistics on the Indian Economy (dbie.rbi.org.in (dbie.rbi.org.in/) ).

More News

- India’s External Debt as at the end of March 2011

- Sources of Variation in Foreign Exchange Reserves in India during 2010-11

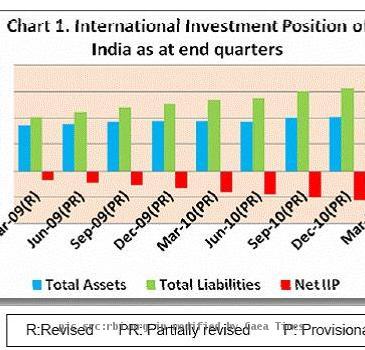

- India’s Quarterly International Investment Position: March 2011

- Developments in India’s Balance of Payments during the Fourth quarter (January-March 2011) of 2010-11

- Results of Underwriting Auctions

- RBI Reference Rate for US $ and Euro

- Liquidity Adjustment Facility : Auction Results