House rejects adding mortgage relief through bankruptcy to Wall Street regulation bill

By APFriday, December 11, 2009

House kills mortgage relief in Wall Street bill

WASHINGTON — The House has rejected an effort to expand a Wall Street regulation bill with mortgage relief that would let debt-ridden homeowners reduce their payments in bankruptcy court. The vote was 241-188 to reject.

The provision would have revived a previous bill that passed the House but later failed in the Senate.

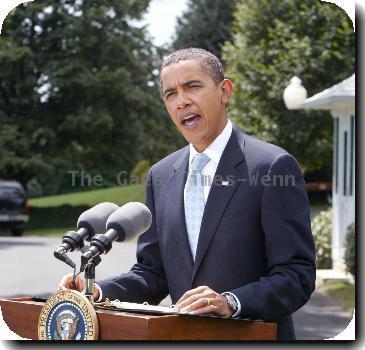

Democrats hoped that by inserting the provision in the regulatory legislation they would have had another opportunity to make it law. Aiding homeowners through bankruptcy had been a key feature of President Barack Obama’s foreclosure fighting proposal, but the president did not push for it.

Banks and credit unions have lobbied against the bankruptcy measure. They say it would force a flood of bankruptcy filings and ultimately drive up mortgage rates.

THIS IS A BREAKING NEWS UPDATE. Check back soon for further information. AP’s earlier story is below.

WASHINGTON (AP) — House Democrats headed into the final stretch on a long-awaited Wall Street regulation bill Friday with two crucial and contentious votes looming before they can declare victory on one of President Barack Obama’s legislative priorities.

The sweeping regulatory overhaul aims to address the myriad conditions that led to last year’s financial crisis.

Two days of debate indicate that Democratic support for the underlying legislation will hold in final passage. Prodded by moderates, however, nearly half the Democrats teamed up with Republicans late Thursday to loosen restrictions on derivatives and reject tougher regulations.

Before a final vote Friday, House members will have to decide whether to support an amendment to kill a proposed Consumer Financial Protection Agency, one of the central features of the legislation. The agency would consolidate consumer lending regulations and enforcement that is now split among several banking regulators.

Eliminating the consumer agency could cost the overall bill support from liberals.

Democratic leaders were also seeking to revive legislation that would let bankruptcy judges rewrite mortgages to lower homeowners’ monthly payments. A coalition of banking organizations on Thursday sent lawmakers a letter urging them to vote against the amendment. The House previously passed bankruptcy-mortgage legislation, but it failed in the Senate.

Democrats were looking for another shot, however, hoping that by inserting the provision in the regulatory legislation, it would be subject to negotiations with the Senate after senators approve their version of a financial rules overhaul.

“This is intended to address this foreclosure crisis without taxpayers having to put money into the deal,” said Rep. Jim Marshall, a Democrat.

Republicans criticized the measure, saying it did not belong in regulation legislation. Rep. Bob Goodlatte, a Republican, argued many would seek bankruptcy help simply because their homes were mortgaged for more than they are worth.

“These borrowers should live with responsibility for their decisions, not receive bailouts from bankruptcy court,” he said.

Late Thursday, scores of Democrats voted with Republicans on amendments that eroded the reach of proposed regulations on complex derivatives trades.

Democratic attempts to toughen the legislation failed.

Though not major setbacks, the votes illustrated the difficulties facing House Financial Services Chairman Barney Frank and the Obama administration as they seek to pass the most ambitious rewrite of financial regulations since the New Deal of the 1930s.

The U.S. Chamber of Commerce has been an aggressive opponent of the legislation, running television ads against the proposed consumer agency and pressuring lawmakers to vote to eliminate it and to ease the derivatives regulations.

The legislation still imposes restrictions on derivatives, aiming to prevent manipulation in and bring transparency to a $600 trillion global market. An amendment by New York Democrat Scott Murphy, adopted 304-124 Thursday night, exempted businesses that trade in derivatives, not as financial speculators, but to hedge against market fluctuations such as currency rates or gasoline prices. The amendment also provided an exception for businesses that are considered too small to be a risk to the financial system.

On the Net:

Congress: thomas.loc.gov/

Tags: Barack Obama, Government Regulations, Industry Regulation, North America, Personal Bankruptcy, Personal Finance, Personal Loans, Real Estate, United States, Washington