A year later, diminished hopes, uncertain future for Obama administration’s housing plan

By Alan Zibel, APWednesday, February 17, 2010

A year later, reality sets in on housing

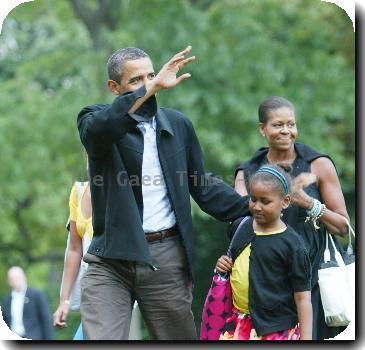

WASHINGTON — The new president climbed aboard Air Force One a year ago for a trip to Phoenix to reveal his strategy for attacking the housing crisis. It was a signal moment in the buoyant early days of Barack Obama’s administration.

The plan, Obama told a cheering audience of high school students, would keep as many as 9 million people in their homes by lowering their monthly mortgage payments. The program wouldn’t save every home, Obama cautioned, but few people paid attention. Not with Treasury Secretary Timothy Geithner saying things like, “You’ll start to see the effects quite quickly.”

Ambition, though, got far ahead of reality.

The numbers show a program that failed to deliver. About 116,000 homeowners have had their loans modified to reduce their monthly payments, the Treasury Department said Wednesday. Only about $15 million in incentive money has been paid to more than 100 participating mortgage companies. That’s 0.02 percent of the $75 billion available.

“We were attempting to set realistic expectations, but I think we failed to do so,” Michael Barr, an assistant Treasury secretary, said in an interview.

Interviews with officials in the Obama and Bush administrations, bank executives and housing experts show the government launched the effort without thinking through many of the details of such a complex program. Banks were ill-prepared, as well. To implement the program, it took months to hire and train thousands of new workers — many of whom had no previous experience in the mortgage industry.

The economy also worsened. Unemployment soared to 10 percent, and home prices continued to fall, especially in Arizona, California, Florida and Nevada. Nearly 16 million homeowners nationwide now owe more to the bank than their properties are worth, according to Moody’s Economy.com.

The dismal results of Obama’s mortgage aid program now raise doubts about whether the government can fix the housing crisis. Low interest rates and tax incentives have boosted home sales, but are ending soon. The $1.25 trillion program created by the Federal Reserve that has helped keep rates low is scheduled to end next month. The tax credits run out on April 30.

At the same time, hundreds of thousands of foreclosed homes will hit the market this year, depressing prices even more.

“Realistically, we still have massive problems. When exactly are we going to deal with it?” said Christopher Thornberg, a Los Angeles economist who long warned that the housing bubble would burst.

No one is quite sure. An increasing number of people are opting to walk away from mortgages because they owe more on their mortgages than their homes are currently worth. That could cause home prices, which stabilized last year, to sink again.

Obama’s plan had two main strategies: The government would channel $75 billion to banks to prod them into modifying the terms of mortgages for up to 4 million borrowers by the end of 2012. It would also relax rules to let up to 5 million homeowners refinance at lower interest rates.

Under the modification plan, borrowers can get their mortgage rates reduced to as low as 2 percent for five years and have the term of their loan extended to as long as 40 years. Borrowers must make three payments on time before the modification becomes permanent. Monthly payments for borrowers in the program have fallen to a median of about $835, down by about $520 a month.

Since the program started in March:

—1 million people have entered the modification program, and almost 12 percent, or 116,000, have completed the process.

—A third of homeowners who made the three monthly trial payments on time have now fallen behind.

—More than 61,000 homeowners have dropped out, and hundreds of thousands more are expected to do so in the coming months.

—About 220,000 homeowners whose homes have plummeted in value have refinanced.

The process has been time-consuming, bureaucratic and fraught with communication mistakes. Borrowers often feel lost in a maze. When denied by their bank, they often don’t get a clear explanation of why.

To qualify, borrowers need to provide two pay stubs and a letter describing the reason for their hardship. They must give the Internal Revenue Service permission to give out their tax returns to their mortgage company.

Patience is running thin among many homeowners.

Joseph Romanski, 56, of Coram, N.Y. had been trying to get a modification from Bank of America since July. He relies on rental income and unemployment to pay as much of his $2,200 a month mortgage as he can afford. He has been looking for help since work at his brother’s roofing company dried up due to the recession.

Romanski was initially told he would qualify for Obama’s program, but then waited several months for an official offer. None came.

After the Associated Press inquired about his case, the bank called Romanski to tell him he doesn’t earn enough to qualify. Instead, the bank offered to reduce his mortgage to $800 a month for three months and is evaluating longer-term options.

“It seems like they want me to just forget about it and give up on it ,” Romanski said. “I couldn’t tell you how many people I’ve spoken to.”

Obama officials initially made it seem that the program would be ready for borrowers a few weeks after the president’s announcement. Instead, mortgage companies were barely ready by May.

“The program was announced long before a true program existed,” said Mike Heid, co-president of Wells Fargo’s home mortgage division.

Faced with poor results last summer, the Obama administration pressured mortgage companies. Treasury officials summoned key executives from lenders, including Bank of America, Wells Fargo and JP Morgan Chase, to Washington. The industry was given strict orders: Sign up at least 500,000 borrowers by Nov. 1.

To meet that goal, most companies allowed homeowners to enroll in the program without proof of income. That was the same low standard that lenders used when they made some of the riskiest loans that fueled the housing frenzy.

Getting the documents in advance would have been a better idea, Heid said. That’s because lenders have struggled to get homeowners to complete all the required documentation. Many don’t comply, despite repeated phone calls, mailings and even in-person visits by notaries.

It’s a problem that has perplexed and frustrated industry executives. “Borrowers didn’t understand that if they didn’t send the documents in, they would fail to qualify,” said Sanjiv Das, Citigroup’s top mortgage executive.

Last month, the Obama administration made key changes. It reduced the paperwork requirements and announcing that homeowners will be required to provide proof of their incomes upfront starting June 1.

“President Obama is finding that, well, it actually is pretty hard” to fix the foreclosure mess, said Phillip Swagel, a Treasury official under President George W. Bush. “It’s very easy to say ‘you need to do more.’ But it’s very difficult to find something that is more — and can be done.”

Tags: Barack Obama, Geography, Housing Policy, North America, Personal Finance, Personal Loans, Personnel, Real Estate, United States, Washington