Papandreou: positive reaction from Obama to European push for crackdown on speculators

By Desmond Butler, APTuesday, March 9, 2010

Greek PM urges US to crackdown on speculators

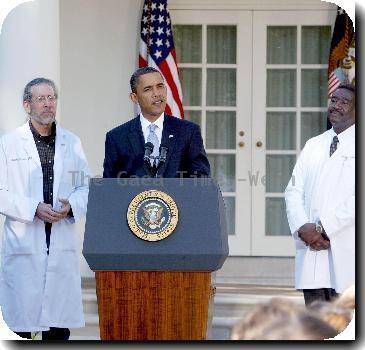

WASHINGTON — President Barack Obama stood with Greek Prime Minister George Papandreou on Tuesday and pledged that the United States would work with its ally, even as Greece’s enormous debts sparked frenzied trading.

Papandreou said he outlined European proposals in his White House meeting and Obama reacted positively to European ideas about cracking down on currency speculation. He also said the issue would be discussed at the next meeting of the Group of 20 summit of leading and emerging economies in June.

Earlier Tuesday, European officials urged the U.S. to curb certain financial instruments.

A market frenzy in recent weeks saw traders make bets worth billions of dollars against the euro and on the chances of Greece not repaying its massive debts. Those market worries have undermined the 16-country currency.

Papandreou said he also detailed steps that Greece has taken to reduce its deficit and reform its economy.

During a reception for Greek Independence Day in the East Room, Obama drew applause from a largely Greek-American audience when he said, “Whether in good times or in bad times, the people of Greece will always have a friend and a partner in the United States of America.”

Obama added: “This solidarity continues today — whether it’s the close counterterrorism efforts between our governments or the deep partnerships between our people.”

The president made no mention of the financial proposals.

The Greek leader also met with U.S. lawmakers Tuesday, including House Speaker Nancy Pelosi.

“The Greek people can be assured that the United States will stand with them at this critical time,” Pelosi said in a brief joint appearance with the Greek prime minister.

In a boost for Papandreou, Homeland Security Secretary Janet Napolitano announced Tuesday that Greece had been finally added to a list of countries whose citizens do not need visas for tourist visits to the U.S. Most European countries already enjoy that privilege, so the issue has been sensitive for the Greek government, which has been pleading for years to join the visa waiver program.

“As the prime minister and I discussed this afternoon, Greece’s participation in the visa waiver program will strengthen security in both our countries,” Obama said. “And whether it’s to do business or visit family and friends, it will now be easier for our Greek friends to visit the United States.”

Papandreou’s trip to Washington along with his finance minister, George Papaconstantinou, comes as Greece tries to climb out of a steep economic hole that widened after Papandreou’s Socialist party came to power in October and revealed that its budget deficit was far worse than the previous government had disclosed.

Greece revised its budget deficit to 12.7 percent of gross domestic product for 2009 from below 4 percent earlier that year.

Papandreou’s trip is part of a four-nation tour aimed at boosting Greece’s financial credibility and winning support for more favorable interest rates for loans. Papandreou says the solution lies with support from European Union countries. He was in the United States as the Obama administration and Congress are considering major changes in the U.S. financial system designed to prevent future activities such as those that caused a major recession in Obama’s first year in office.

“I found a very positive response from the president,” Papandreou said of Obama’s reaction to his call for currency trading reforms.

Papandreou and other European leaders have been urging the U.S. to take specific action on currency trading. The EU has said it is considering banning financial instruments including certain credit default swaps that it believes have exasperated the global financial crisis.

Credit default swaps are a form of insurance for buyers to protect them against the risk that a seller or borrower would default on a security such as a government bond. In “naked” sales, the buyer does not hold the underlying asset and faces no such risk — but can make a profit on the swap itself.

Papandreou on Monday compared the practice of selling naked credit default swaps to buying insurance on a neighbor’s house and then burning it down to collect.

Tuesday in New York, the head of the U.S. Commodity Futures Trading Commission renewed his call for new regulation of the $600 trillion global financial derivatives market. CFTC Chairman Gary Gensler said such action would “greatly reduce” the risk posed by credit default swaps, which account for an estimated $60 trillion of the derivatives trade.

However, Gensler added in a speech, “additional reforms … should be considered to address the unique characteristics” of credit default swaps.

Papaconstantinou warned in an interview with The Associated Press that leading economic powers have not yet implemented the changes needed to avoid another financial crisis.

“The real question that we should be asking ourselves on both sides of the ocean is, ‘Have we learned the lessons of that financial crisis?’” he said. “I think the honest answer is that despite some political will to do so, we haven’t actually taken all the necessary measures.”

Tags: Barack Obama, Europe, Government Regulations, Greece, Industry Regulation, North America, Passports And Visas, United States, Washington, Western Europe