5 states have just weeks to craft plans to spend $1.5B to help struggling homeowners

By Bob Christie, APMonday, March 15, 2010

5 states rush plans for $1.5B in housing funds

PHOENIX — The five states hardest hit by the foreclosure crisis have been given only weeks to plan how to spend $1.5 billion in federal funding announced by the Obama administration last month.

Guidelines issued under the U.S. Treasury Department’s Fund for Hardest Hit Housing Markets on March 5 gave housing finance agencies in California, Arizona, Florida, Nevada and Michigan just six weeks to come up with plans on how to spend their share of the money.

The rush could be problematic for the states, especially because Treasury is seeking “innovative” measures to help families facing foreclosure. But some experts have been urging the administration to try the approach, believing it will be helpful and that it can be done quickly.

“This is long overdue, allowing the use of more innovative techniques,” said Ken Rosen, a real estate professor at University of California at Berkeley’s Hass School of Business.

The guidelines give wide leeway to the state Housing Finance Agencies charged with doling out the money to design programs tailored to their region’s circumstance. The money can be spent, for example, to help families who can’t pay their mortgages because of job losses, unable to refinance because plunging home values have left them “underwater,” or to give relief from second mortgage payments.

California’s Housing Finance Agency, for example, is looking at areas of the state that have been hardest hit, like the Central Valley and Inland Empire area southeast of Los Angeles, spokesman Ken Giebel said. The agency is getting the most cash, $700 million.

It will have to start from scratch with plans on how to help unemployed homeowners, for instance, and how to get the money from the federal government to the state government to the actual underwriter.

“None of this stuff is in writing, it’s all up in the air right now,” Giebel said.

Rosen suggested allowing the value of a home that is worth less than the homeowner owed to be written off, replacing that amount with a second mortgage that wouldn’t have to be paid off unless the home rose enough in value.

The homeowner would then share in the profits, providing an incentive to stay in the home. He also said programs to allow the unemployed to forgo payments for a year, with those payments wrapped into a second mortgage, would be helpful.

“There’s a lot of innovative ideas and I’m hoping we have a lot of smart people in each state who know them; I know we do in California,” Rosen said. “So I think there’s plenty of time.”

Florida is getting the second-largest share at $418 million.

Cecka Rose Green, communications director for the Florida Housing Finance Corporation, said her agency is just starting to review the Treasury requirements, but has put a team together and is reviewing programs other agencies are using. They’re looking at plans that have helped in other states and will likely cherry-pick the best.

“I think we’re taking those important first steps but we’re not close to getting any details of a plan out,” she said Friday.

Michigan is getting $154.5 million, Nevada $103 million and Arizona $125 million.

Arizona’s housing agency is also just getting started on a proposal and hasn’t identified how it might spend the money.

“I know we have a compressed time frame, but we are still looking at a number of ideas and I don’t know what we’ll be focusing on yet,” said state Department of Housing spokeswoman Kristina Fretwell.

Like other states’ officials interviewed for this story, Fretwell said there was no doubt that Arizona would get an application in by the April 16 deadline. Treasury will then spend several weeks reviewing the proposals, with a goal of getting the first cash to homeowners by summer.

The Obama administration’s plans to aid homeowners who fall behind on their payments have been problematic. The biggest effort, the Making Home Affordable program, has helped only about 16 percent of the borrowers who signed up since its launch last year. Figures released by the Treasury Department on Friday showed that as of last month, about 170,000 homeowners had had their payments reduced permanently, of which nearly 77,000 were in the five hardest hit states. About 1.1 million have enrolled in the plan overall.

Not all academics who have studied the real estate crisis agree that spending more money trying to keep people in their homes is a smart idea.

“The solution we all know that has to be done — and this sounds harsh — the borrowers have to be allowed to move through foreclosure and the houses have to be put on the market so we can get to the bottom of this mess,” said Anthony Sanders, a real estate professor at George Mason University who has testified before Congress on the foreclosure crisis.

Sanders called the $1.5 billion both too little and too much — too little, because the housing crisis has hit so many homeowners that $1.5 billion is tiny compared to the need, and too much because it targets homeowners who really can’t afford to be in their home anyway.

He pointed to the more that 70 percent of homeowners who went back into default after government mortgage relief efforts.

He also criticized letting state housing finance agencies, which are designed to help low- and middle-income borrowers, decide how to spend the money.

“To think that state agencies, who are not very good at this, are going to come up with an innovation is just kind of wishful thinking.”

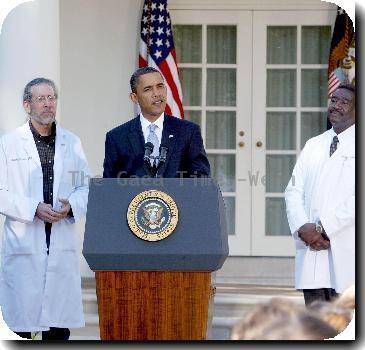

The new program announced by President Barack Obama in February is meant to get more help to states where housing prices have declined by at least 20 percent.

“The biggest reason and rationale for the timeline is the urgency of the issue,” Treasury spokeswoman Andrea Risotto said. “We want to try to get relief out to these homeowners as quickly as we can.”

Tags: Arizona, Barack Obama, California, Florida, North America, Personal Finance, Personal Loans, Phoenix, Real Estate, United States