Stocks recover after Obama speech on financial reform; upbeat home sales report lifts builders

By Tim Paradis, APThursday, April 22, 2010

Stocks recover after Obama speech, home sales data

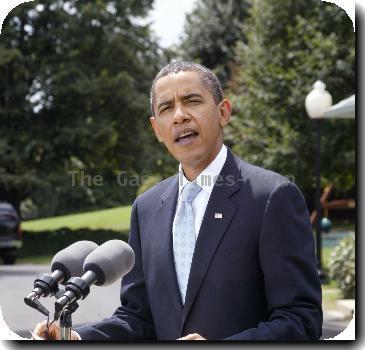

NEW YORK — The stock market recovered from early losses and closed modestly higher Thursday after President Barack Obama’s speech on financial reform contained no unpleasant surprises.

The Dow Jones industrial average rose about 9 points after being down about 108. Broader indexes also turned higher.

The market fell sharply early in the day as Greece’s debt problems worsened and on fears that Obama would advocate tough restrictions on banks. When he didn’t, stocks recovered.

Prices also got a boost from a jump in sales of existing homes last month.

In a speech in New York, Obama said the economy is recovering quickly but the progress needs to be felt more deeply among the millions of unemployed Americans. He has blamed Wall Street for helping push the country into recession. Obama gave a speech in support of his efforts to pass legislation that would overhaul financial markets.

The Senate could debate the financial overhaul bill next week. The House has already passed its own version.

Investors were rattled early in the day by news about Greece. The country’s borrowing costs surged again when Europe’s statistics agency found that Greece’s budget deficit last year was even larger than previously thought. The findings pushed Greece closer to tapping loans from 15 European countries and the International Monetary Fund. Moody’s Investor Services downgraded Greece’s debt and said more downgrades could be coming.

“It rings the alarm bell at least in the very short-term,” said Steven Goldman, chief market strategist at Weeden & Co., referring to the latest problems in Greece.

Greece’s debt crisis has undermined confidence in Europe’s shared currency, the euro, and raised the troubling possibility that other weak European economies such as Portugal may also need to be bailed out.

Investors sent homebuilder stocks higher after the National Association of Realtors said sales of existing homes rose 6.8 percent last month after falling 0.8 percent in February. Sales of previously occupied homes had been expected to rise 5.2 percent, according to Thomson Reuters.

Stocks have been climbing steadily over the past 13 months, and the gains in the past two months have come with very few breaks. Many analysts have been expecting a break in the market’s ascent, which would be in keeping with historical patterns. As occurred Thursday, most recent drops have faded quickly as buyers step in.

The Dow rose 9.37, or 0.1 percent, to 11,134.29. The Standard & Poor’s 500 index rose 2.73, or 0.2 percent, to 1,208.67, while the Nasdaq composite index rose 14.46, or 0.6 percent, to 2,519.07.

Bond prices fell, lifting yields. The yield on the benchmark 10-year Treasury note rose to 3.78 percent from 3.74 percent late Wednesday.

The dollar rose against other major currencies, while gold fell.

Crude oil rose 2 cents to $83.70 per barrel on the New York Mercantile Exchange.

The Labor Department reported that the number of people applying for unemployment benefits dipped to 456,000 last week, after rising unexpectedly the past couple of weeks. The drop was about in line with expectations.

Homebuilder Hovnanian Enterprises Inc. rose 25 cents, or 4 percent, to $6.57. KB Home rose $1.12, or 6.3 percent, to $18.87.

Stronger corporate earnings reports in the past two weeks have brought an important signal that the economy is recovering. But not all the numbers have been as strong as investors would like.

Shares of eBay Inc. fell $1.51, or 5.7 percent, to $24.78 after the online auction house’s profit forecast fell short of what analysts had been expecting.

Profits at mobile phone maker Nokia Corp. missed analysts’ forecasts. The stock fell $1.96, or 13.1 percent, to $12.99. Dow component Verizon Communications Inc. reported better-than-expected earnings but the stock fell after the company brought in fewer new customers than predicted. Verizon fell 28 cents, or 1 percent, to $29.28.

Two stocks rose for every one that fell on the New York Stock Exchange, where consolidated volume came to 6 billion shares compared with 5.7 billion Wednesday.

The Russell 2000 index of smaller companies rose 8.12, or 1.1 percent, to 734.31.

Britain’s FTSE 100 dropped 1 percent, Germany’s DAX index fell 1 percent, and France’s CAC-40 fell 1.3 percent. Japan’s Nikkei stock average fell 1.3 percent.

Tags: Barack Obama, Commodity Markets, Construction Sector Performance, Europe, Greece, Home Selling, New York, North America, Real Estate, Residential Real Estate, United States, Western Europe