Stocks set to reverse 3-day losing streak; futures trading higher as dollar weakens

By Stephen Bernard, APMonday, November 23, 2009

Stock futures point to higher opening

Stock futures are rising Monday, pointing to a higher opening after ending January with a loss.

The White House, meanwhile, sent Congress a $3.83 trillion budget proposal that anticipates a record-setting budget deficit. A handful of economic reports, including personal income data, are expected to be released that could shed more light on the state of the recovery.

ExxonMobil Corp., meanwhile, is the most prominent of those expected to report on 2009 earnings on Monday.

Meanwhile, Toyota is revealing its plans to fix gas pedals in more than 2 million vehicles being recalled in the U.S. The pedals can get stuck or are slow to return when released, increasing the risk of a crash.

Dow Jones industrial average futures rose 38, or 0.4 percent, to 10,055. Standard & Poor’s 500 index futures rose 4.00, or 0.4 percent, to 1,074.40, while Nasdaq 100 index futures rose 5.25, or 0.3 percent, to 1,744.50.

Stocks ended a disappointing January with a loss as worries about future economic growth and company profits weighed on investors. The Dow fell 0.5 percent on Friday, and is now down 6.1 percent since reaching its 15-month high of 10,725.43 on Jan. 19.

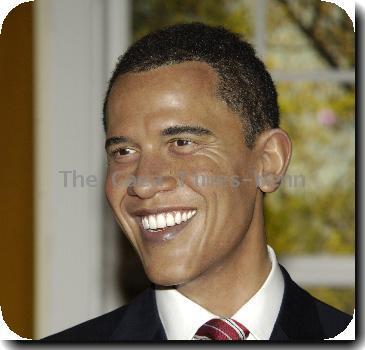

On Monday, President Barack Obama sent the U.S. Congress a $3.83 trillion budget that would pour more money into the fight against high unemployment and boost taxes on the wealthy. The nation’s unemployment rate currently sits at 10 percent.

The deficit for this year would surge to a record-breaking $1.56 trillion, topping last year’s then unprecedented $1.41 trillion gap. The deficit would remain above $1 trillion in 2011.

The Commerce Department reports later Monday construction spending for December. Forecasts expect spending fell 0.5 percent in December, after falling 0.6 percent in November.

And the Institute for Supply Management issues its manufacturing index for January. Economists expect that the index fell to 55.5 in January, down from 55.9 in December. A reading of 50 or above means the sector is growing.

Both the construction spending and manufacturing index reports are set for release at 10 a.m. EST.

Meanwhile, bond prices fell. The yield on the benchmark 10-year Treasury note, which moves opposite its price, rose to 3.63 percent from 3.60 percent late Friday. The yield on the three-month T-bill, considered one of the safest investments, rose to 0.08 percent from 0.06 percent.

The dollar mostly rose against other major currencies, while gold prices fell.

Overseas, Japan’s Nikkei stock average rose 0.1 percent. In afternoon trading, Britain’s FTSE 100 was up 0.1 percent, Germany’s DAX index was down 0.1 percent, and France’s CAC-40 was down 0.3 percent.

Tags: Barack Obama, Christmas, Comcast, Commodity Markets, Construction Sector Performance, Consumer Spending, Europe, Geography, Greece, Home Selling, Labor Economy, Manufacturing Sector Performance, New York, North America, Prices, Real Estate, Residential Real Estate, Thanksgiving, United States, Western Europe