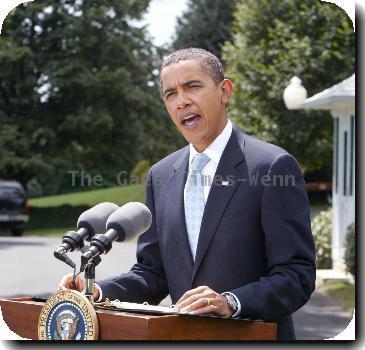

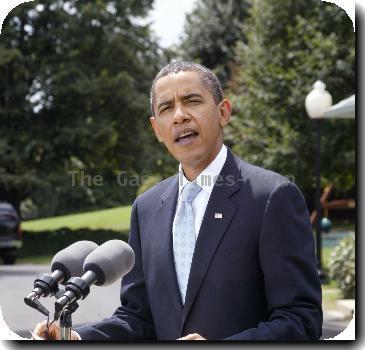

Obama meeting banking executives, wants their support for consumer protection agency

By Philip Elliott, APMonday, December 14, 2009

Obama pushing banking execs on protection agency

WASHINGTON — President Barack Obama is asking bank executives to support his efforts to tighten the financial industry, while bankers are prepared to tell the president he should stop oversimplifying their concerns if he wants good-faith collaboration.

An hourlong meeting between the president, his economic team and the nation’s top financial firms began Monday at the White House. Even before it began in the Roosevelt Room, it had the makings of a tense encounter, in part because of Obama’s description of bankers as “fat cats.”

Administration officials described the meeting as a continuation of discussions the president initiated early in his tenure and the latest push for lenders to take greater responsibility as the nation combats an economic crisis that began on Wall Street.

Specifically: Wall Street should fall in line with Obama and back a proposal for a consumer protection agency that cleared the House last week.

“I did not run for office to be helping out a bunch of fat cat bankers on Wall Street,” Obama told CBS’s “60 Minutes” in an interview that broadcast Sunday.

Financial industry officials braced for Obama’s tough tone. They planned to press a conciliatory message and highlight areas where they agree with the administration while smoothing over their differences.

But the executives also planned to stand up to the president on issues where they feel his statements oversimplify their positions — particularly the creation of the Consumer Financial Protection Agency — according to people familiar with their thinking who spoke anonymously because they were not authorized to discuss the plans.

“He can say what he wants, but we’re not going to go back to the kind of lending that put us in this mess,” said a person who is helping prepare executives for the meeting. A dozen executives were on the list of those coming, from Goldman Sachs Group Inc., Bank of New York Mellon Corp., Bank of America Corp., Citigroup Inc., U.S. Bancorp , JPMorgan Chase & Co., Morgan Stanley and more.

Citigroup Inc. said Monday that it is repaying $20 billion in bailout money it received from the Treasury Department, in an effort to reduce government influence over the banking giant. The government will also sell its stake in the company.

The New York-based bank was among the hardest hit by the credit crisis and rising loan defaults and got one of the largest bailouts of any banks during the financial crisis. The government gave it $45 billion in loans and agreed to protect losses on nearly $300 billion in risky investments. Wells Fargo & Co. remains the last national bank that has yet to pay back its bailout money.

The bailout repayment news kept Citigroup CEO Vikram Pandit from attending Monday’s meeting, Citi spokeswoman Molly Millerwise Meiners said. She said chairman Richard Parsons planned to attend but bad weather kept him from reaching Washington in time.

The White House said Parsons and two other executives would be attending by telephone “due to inclement weather.” The two others were Goldman Sachs chairman and CEO Lloyd Blankfein and Morgan Stanley chairman and CEO John Mack.

Bankers expected the regulatory overhaul to provide the meeting’s most contentious moments. They believe the president has mischaracterized them as being against the new rules, when in fact they support the vast majority of the administration’s proposals.

“These same banks who benefited from taxpayer assistance … are fighting tooth and nail with their lobbyists up on Capitol Hill, fighting against financial regulatory control,” Obama said in the “60 Minutes” interview.

Tags: Barack Obama, North America, Personnel, Tv News, United States, Washington