Infogroup shareholders approve selling the database provider to CCMP for about $460 million

By Josh Funk, APTuesday, June 29, 2010

Infogroup shareholders approve company’s sale

OMAHA, Neb. — Infogroup shareholders voted Tuesday to approve the database provider’s $460 million sale to private equity firm CCMP Capital Advisors.

The $8 per share that New York-based CCMP offered had been criticized by two of Infogroup’s biggest shareholders. But the deal was approved thanks to the backing of Infogroup founder Vinod Gupta, who lost control of the company in 2008 because of questions about his spending but who still holds about 35 percent of the stock.

Infogroup’s board unanimously recommended the sale when it was announced in March. The deal also includes refinancing of about $175 million of Infogroup’s debt.

Infogroup shares gained 7 cents to sell for $7.99 Tuesday morning after the special shareholder meeting. The deal is expected to close on July 1.

Infogroup board member Gary Morin, who led the mergers and acquisition committee, said Tuesday that the deal was in the best interest of shareholders, so he was pleased it had been approved.

The Omaha-based company had defended the deal’s price as fair because it was 22 percent higher than the company’s stock price before sale rumors were reported in October.

Two investment firms that together held about 11 percent of Infogroup’s stock — Hotchkis and Wiley Capital Management and Stonerise Capital Partners — objected to the deal as underpriced and ill-timed.

Los Angeles-based Hotchkis and Wiley and San Francisco-based Stonerise sent letters to Infogroup’s board objecting to the terms, but they did not succeed in scuttling the deal.

Gupta was the chief executive and chairman of the company, which used to be known as InfoUSA, from 1992 through August 2008. He lost those positions in 2008 after a shareholder lawsuit raised questions about his use of company money to support a lavish lifestyle.

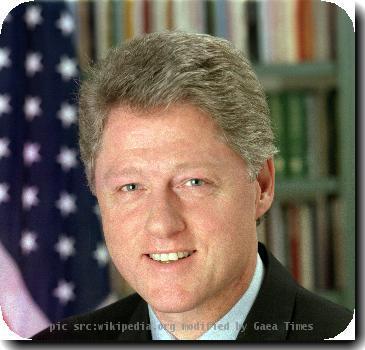

The lawsuit alleged that Infogroup misspent millions of dollars, some of it on domestic and international air travel for former President Bill Clinton and his wife, then-Sen. Hillary Rodham Clinton.

Gupta pledged to reimburse InfoGroup $9 million over five years as part of the lawsuit settlement announced in August 2008, but he remained on the company’s board and received $10 million severance. Gupta resigned from Infogroup’s board right after voting to recommend the CCMP deal, and he agreed in March to pay more than $7.3 million to settle an SEC investigation into the way he used more than $9 million of Infogroup’s money to support an extravagant lifestyle.

Online:

InfoGroup Inc.: www.infogroup.com

CCMP Capital Advisors LLC: www.ccmpcapital.com

Tags: Bill Clinton, Nebraska, North America, Omaha, United States