Obama says premium hikes by WellPoint are reason for reform, insurer blames recession, costs

By Tom Murphy, APThursday, February 11, 2010

WellPoint insurance hike becomes target for Obama

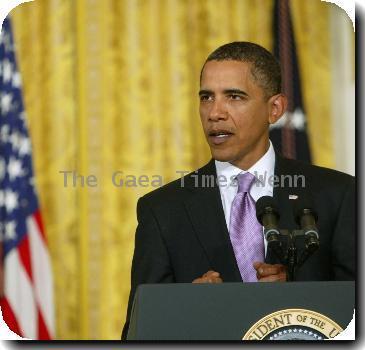

INDIANAPOLIS — Health insurer WellPoint blames the Great Recession and rising medical costs for its planned 39 percent rate increase for some California customers. To President Barack Obama, however, its Exhibit A in his campaign to revive the health care overhaul.

Health and Human Services Secretary Kathleen Sebelius, who received the company’s explanation in a letter Thursday, said “it remains difficult to understand” how premium increases of that size by can be justified when WellPoint Inc. reported a $2.7 billion profit in the last quarter of 2009.

“This is a stark illustration of what the status quo means for American families,” said White House spokesman Reid Cherlin. “You’d be hard-pressed to find a better example of why reform is so urgent, and it’s going to continue to be part of the case the president makes.”

Majority leader Harry Reid, D-Nev., went further. In a speech on the Senate floor, he attacked WellPoint and other “greedy insurance companies that care more about profits than people.”

“They get rich while people who already can barely afford their coverage lose their coverage altogether,” Reid said.

Whether it will be enough to re-ignite the sputtering health care legislation, remains uncertain. The Democratic bills are stalled for political and policy reasons unrelated to insurance costs. Democrats in the House can’t accept the health care bill that Democrats in the Senate have produced, and vice versa. There are also concerns about the cost of the legislation.

The rate hike shock, however, could help Obama make his case that Republicans need to come to the table on health care. GOP leaders, who want to start talks over from scratch, are going reluctantly to the Feb. 25 health care summit convened by the president.

Brian Sassi, the head of WellPoint’s consumer business unit, said in his letter to Sebelius that the weak economy is leading individual insurance buyers who don’t have access to group plans to drop coverage or buy cheaper plans. That reduces the premium revenue available to cover claims from sicker customers who are keeping their coverage.

The result was a 2009 loss for the Anthem Blue Cross unit that sells individual policies to people who don’t get insurance through their employers, he said. Higher rates for this group, which accounts for about 10 percent of Anthem’s eight million customers in California, are needed to cover the shortfall expected from the continuation of that trend, according to the letter.

“When the healthy leave and the sick stay, that is going to dramatically drive up costs,” Sassi said in an interview. He declined to specify the size of the unit’s loss.

Affected customers can choose plans with lower premiums but higher out-of-pocket costs, he said.

Sassi told Sebelius that insurance costs also continue to rise because medical prices are increasing faster than inflation, and people are using more health care. That use increase is driven by an aging population, new treatments and “more intensive diagnostic testing,” he wrote.

Sebelius ordered a federal inquiry earlier this week after the size of proposed premium increases for individual policies was widely publicized. A congressional committee also has asked for information on the increases and requested testimony from WellPoint CEO Angela Braly at a Feb. 24 hearing.

“A lot of companies are hurting in this economy but this California health company isn’t one of them,” Reid said, citing Wellpoint’s profits.

“That’s why we need health reform like the bills already passed by the House and Senate that will rein in insurance company abuses and make coverage more affordable for millions of Americans, and provide coverage for some 30 million that have no health insurance,” he said.

But Sassi disputed that notion in his letter to Sibelius. He said both the House and Senate bills carve too many loopholes from a requirement that everyone buy health insurance. He said they are also weak on enforcement and set penalties that are too low to ensure compliance.

WellPoint is the largest publicly traded health insurer based on membership and is a dominant player in the individual insurance market in California. Based in Indianapolis, the company runs Blue Cross and Blue Shield plans in 14 states and Unicare plans in several others.

WellPoint’s profit for all of 2009 was $4.75 billion, though $2 billion of that came from the sale of a business.

Rates for individual health insurance policies tend to rise much faster than those of employer-sponsored coverage.

The pool of customers is more stable for group health insurance. In the individual market, healthy people are more inclined to drop coverage when they see big price hikes because they don’t have employer help paying for it, said Robert Laszewski, a health care consultant and former insurance executive. That leaves behind sicker customers who stay because they still need coverage.

Sassi said as much as one-third of their individual insurance customers leave every year. That volatility can lead to big changes in the mix of people covered and rate swings. Administrative costs also can be higher for individual lines because the insurer has to sell each policy individually instead of to a larger group.

Sassi said a minority of Anthem Blue Cross’s 800,000 individual policy holders in California will see rate increases as high as 39 percent. Most premiums will rise around 24 percent when the rates take effect March 1.

The Democratic health care legislation now stuck in Congress is largely aimed at addressing the problems of small businesses and people buying insurance on their own.

Associated Press reporter Erica Werner in Washington contributed to this report. Alonso-Zaldivar reported from Washington.

WellPoint’s letter: www.wellpoint.com/pdf/SebeliusLetter02112010.pdf

Tags: Access To Health Care, Barack Obama, California, Geography, Government Regulations, Health Care Reform, Health Issues, Indiana, Indianapolis, Industry Regulation, North America, Personal Finance, Personal Spending, Political Issues, Recessions And Depressions, United States