China’s roaring growth raises urgency of debate over currency, stimulus policies

By Elaine Kurtenbach, APThursday, April 15, 2010

China’s robust growth fuels debate over policy

SHANGHAI — The latest surge in China’s growth is welcome news for the global recovery and could give Beijing room to let its currency yuan rise, while adding to pressure to take that step to help cool inflation.

Growth in the world’s third-largest economy accelerated to 11.9 percent in the first quarter, the government reported Thursday. Inflation stayed low, allowing Beijing to avoid drastic steps to slow its boom, which is driving demand for foreign raw materials and consumer goods.

Such dynamic growth could help offset potential losses to China’s exporters from any gains in the value of the country’s yuan, enabling Beijing to go ahead with a widely expected but modest loosening of currency controls.

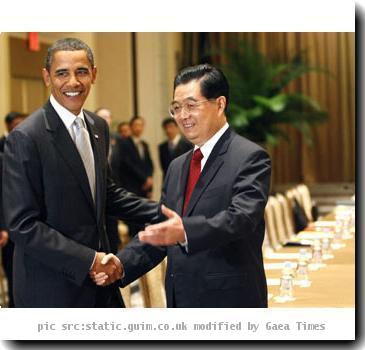

President Hu Jintao and other leaders have rejected American pressure over currency, saying China will move at its own pace. But opinion within China’s economic leadership is divided and most analysts expect Beijing to let the yuan rise sometime this year.

“It will be painful for China to let the yuan appreciate, but I think it will soon after May, though it will certainly be very slow and controlled,” said Qian Qimin, a senior analyst at Shenyin Wanguo Securities.

The government said stimulus measures would remain in place despite the faster growth. It has been gradually lowering bank lending and tightening lending standards but has avoided major changes.

“We face a very complicated external environment, because globally we are seeing a very slow and uneven pace of recovery,” said Li Xiaochao, a spokesman for the National Bureau of Statistics. “We face a lot of uncertainties.”

Prices rose by a modest 2.2 percent for the quarter after inflation eased to 2.4 percent in March from February’s 2.7 percent. But many economists say China runs a growing risk of overheating just a year into its own recovery.

Housing prices rose 11.7 percent in March from a year earlier, their fastest increase ever. After meeting to discuss economic policy twice this week, the Cabinet announced new measures Thursday to curb speculative buying blamed for the boom.

The government raised the minimum downpayment for purchases of second homes from 40 percent to 50 percent. Buyers of third homes or more face even higher downpayment requirements.

The government also said it would free up more land for residential construction.

“People say China’s property market now is even hotter than the U.S. or Dubai’s was, and I completely agree with this,” said Mao Yushi, a prominent economist and commentator.

“I fear the strong growth will blow into a bubble economy, and we all know how dangerous that is. The bubble comes mainly from the overheated property market, and I think the central bank is thinking of raising interest rates to control it.”

Global markets rose on the news from China, but the country’s own benchmark Shanghai index declined on lingering concerns about a possible rate hike.

Mao said he expects the government to finally tackle the currency issue — a chronic irritant in relations with Washington, which has lobbied Beijing to let the yuan rise against the dollar from the level where it has been frozen since the crisis struck in 2008.

On Wednesday, Singapore reported even faster first quarter growth at 32.1 percent, the fastest rate in 35 years, prompting its central bank to announce it would let the country’s currency rise to tamp down inflation.

China is likely to move more gradually due to communist leaders’ reluctance to be seen as giving in to foreign pressure.

“It’s likely the government will move quite cautiously, and maybe wait for another couple months,” said Tom Orlik, an analyst in Beijing for Stone & McCarthy Research Associates.

Orlik said Beijing might take some “cosmetic measures,” such as widening the yuan’s narrow trading band, to help defuse U.S. criticism ahead of an annual meeting next month of the two governments’ Strategic and Economic Dialogue.

A stronger yuan would raise Chinese consumers’ buying power and slow the rise in the price of imported commodities and industrial components in yuan terms.

“It’s a difficult process, but one China’s economy cannot escape, since we have to adjust our economic structure to encourage higher domestic demand,” Mao said.

Associated Press researchers Ji Chen, and Bonnie Cao in Beijing, contributed to this report.

(This version CORRECTS typo ‘Beijing’ in lede)

Tags: Asia, Beijing, China, East Asia, Greater China, Home Buying, Hu Jintao, Prices, Residential Real Estate, Shanghai