Database provider InfoGroup of Omaha sells itself to CCMP private equity for $460M

By Josh Funk, APMonday, March 8, 2010

Private equity firm CCMP buys InfoGroup for $460M

OMAHA, Neb. — Private equity firm CCMP Capital Advisors said Monday it plans to buy database provider InfoGroup Inc. for roughly $460 million cash.

The companies said the total value of the deal would be $635 million because about $175 million of InfoGroup’s debt will be refinanced. But the $8 cash per share investors will receive is less than the $8.16 InfoGroup opened at Monday and less than its 52-week high of $8.99 set in November.

After the deal was announced, InfoGroup shares fell 3 percent, or 24 cents, to $7.92 in afternoon trading.

If the deal closes this summer, as expected, it will end a troubled chapter for Infogroup, which included allegations of improper spending, a Securities and Exchange Commission investigation and the removal of founder Vin Gupta from the CEO job in 2008.

Just five years ago, Gupta told shareholders he believed the stock was worth $18, but later angered some shareholders by offering to buy out the company for $11.75 a share.

InfoGroup Chairman Roger Siboni said the board is pleased with the CCMP deal, which came after the company spent more than a year evaluating its strategic options.

“This transaction fulfills our commitment to maximize the value of Infogroup for all shareholders,” Siboni said.

InfoGroup CEO Bill Fairfield said going private will give the company more flexibility in the way it serves its customers and allow it to focus on long-term goals.

Richard Zannino, CCMP’s capital managing director, says InfoGroup’s innovative, cost-effective marketing tools made it attractive. CCMP is based in New York.

InfoGroup said last fall that it had reached a tentative settlement with the SEC. The company said it wouldn’t admit any wrongdoing or agree to pay a penalty in the proposed settlement. But InfoGroup pledged to make sure its records are accurate and its internal accounting controls are maintained.

InfoGroup began looking at a possible sale after Gupta, who is the largest shareholder, suggested it in late 2008.

Gupta lost the CEO and chairman positions in 2008 after a shareholder lawsuit raised questions about his spending. Gupta pledged to reimburse InfoGroup $9 million over five years, but he remained on the company’s board and received $10 million severance.

InfoGroup also imposed tighter limits on spending as part of a settlement to the shareholder lawsuit, which was filed by investment manager Cardinal Value Equity Partners and hedge fund Dolphin Limited Partnership.

Officials at Cardinal declined to comment Monday morning before reviewing all the details of the deal, and Dolphin officials did not immediately respond to a message left Monday.

The company’s internal investigation confirmed Gupta spent millions of InfoGroup’s money on extravagances such as jet travel, vacation homes, a yacht, and a collection of luxury automobiles.

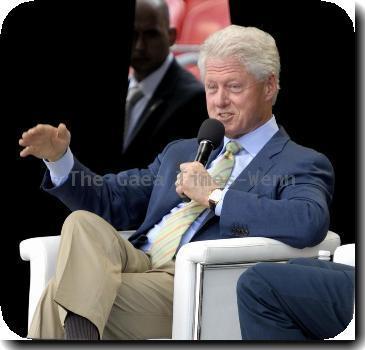

Gupta also spent some of the company’s money on former President Bill Clinton and his wife, Secretary of State Hillary Rodham Clinton, when she was campaigning for the Democratic presidential nomination.

According to the lawsuit, InfoGroup had spent nearly $900,000 between 2001 and 2007 flying the Clintons to domestic and international locations and political events.

On the Net:

InfoGroup Inc.: www.infogroup.com

CCMP Capital Advisors LLC: www.ccmpcapital.com

Tags: Bill Clinton, Corporate Spending, Nebraska, North America, Omaha, Ownership Changes, Personnel, United States