Greater security for consumers, but no free ride in Democratic health care bills

By Ricardo Alonso-zaldivar, APWednesday, December 9, 2009

There’ll be a price for new health care benefits

WASHINGTON — Health care overhaul now looks like it really will happen, with a compromise coming together in the Senate to give uninsured Americans options they’ve never had before. But it won’t be a free ride.

Have your checkbooks and credit cards ready. There’s a price for health care security — particularly for solid middle-class households, who wouldn’t get much help with premiums.

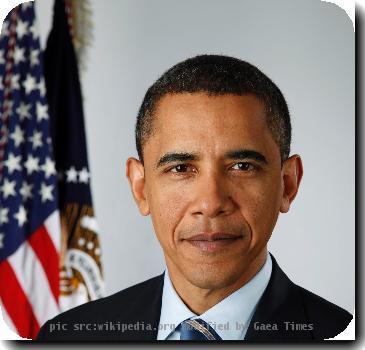

President Barack Obama hailed the Senate agreement Wednesday, building expectations that the yearlong fight over revamping health care had finally come down to the bill now emerging.

That measure, like the Medicare prescription drug benefit that passed when Republicans ran Washington, would offer consumers a dizzying lineup of health plan choices — with different costs and benefits.

“People who need to buy coverage as individuals and small employers are going to have a lot more in the way of attractive health insurance options, and they won’t have to worry about whether their medical condition precludes them from being covered,” said policy expert Paul Ginsburg, who heads the nonpartisan Center for Studying Health System Change.

The downside: “Sticker shock is going to come to some.”

Get ready for a whole new set of trade-offs.

For example, people in their 50s and early 60s, when health problems tend to surface, are likely to pay less than they would now. Those in their 20s and 30s, who get the best deals today, will face higher premiums, though for better coverage.

The tentative deal by Democratic senators would give millions of Americans the option of signing up for private plans sponsored by the federal employee health system, which covers some 8 million, including members of Congress. The compromise, which also offers people age 55 to 64 the option of buying into Medicare, appears to have given Democrats a way around the deal-breaker issue of a new government plan to compete with private carriers. Senators continued to debate for a 10th day, with Democrats pushing to pass the bill by Christmas.

The 2,074-page Senate bill will grow even longer as amendments are considered, but the basic outlines of the legislation most likely to pass are becoming clearer.

The overhaul will be phased in slowly, over the next three to four years. But eventually all Americans will be required to carry coverage or face a tax penalty, except in cases of financial hardship. Insurers won’t be able to deny coverage to people with health problems, or charge them more or cut them off.

Most of the uninsured will be covered, but not all. As many as 24 million people would remain uninsured in 2019, many of them otherwise eligible Americans who still can’t afford the premiums. Lawmakers propose to spend nearly $1 trillion over 10 years to provide coverage, most of the money going to help lower-income people. But a middle-class family of four making $66,000 would still have to pay about 10 percent of its income in premiums, not counting co-payments and deductibles.

No dramatic changes are in store for most people who get coverage through their jobs — about 60 percent of those under age 65. The Congressional Budget Office says the bill wouldn’t have a major effect on premiums under employer plans, now about $13,000 a year. Parents would be able to keep dependent children on their coverage longer, age 27 in the House bill.

One benefit for people with employer coverage is hard to quantify: It should be easier to get health insurance if they’re laid off.

The real transformation under the legislation would come for those who now have the most trouble finding and keeping coverage: people who buy their own insurance or work for small businesses. About 30 million could pick from an array of plans through new insurance supermarkets called exchanges.

Some people’s taxes would go up.

To pay for expanded coverage, the House bill imposes a 5.4 percent income tax surcharge on individuals making more than $500,000 and families earning more than $1 million. The Senate slaps a 40 percent tax on insurance plans with premiums above $8,500 for individual coverage and $23,000 for family plans, among other levies.

The rest of the financing would come mainly from cuts in federal payments to insurers, hospitals, home health care agencies and other medical providers serving Medicare.

Preventive benefits for seniors would be improved. So would prescription coverage. But people enrolled in private plans through the Medicare Advantage program are likely to see higher out-of-pocket costs and reduced benefits as overpayments to insurers are scaled back.

The latest big wrinkles in the debate involve intriguing opportunities for consumers. But even there, it may be less than meets the eye.

Lawmakers have been talking for years about giving average Americans the option of coverage through the federal employee system, “just like members of Congress.” The compromise among Senate Democrats would make plans certified by the federal employee system available nationwide, bringing competition to states in which one or two large insurers now control the market.

The other big new idea is to allow people age 55 to 64, one of the groups now most at risk for losing coverage, to buy into Medicare.

Yet from the inside, the federal employee health benefits plan isn’t looking all that great these days. Federal workers do have a wide choice of insurance plans, but they’re looking at hefty premium increases next year. Individual coverage under the most popular plan is going up 15 percent.

“I don’t think you’ll ever find someone satisfied with the price,” said Jacqueline Simon, policy director for the American Federation of Government Employees. “And you’ve got people who are priced out.” The union estimates that 250,000 federal workers are uninsured, mostly because they can’t afford the premiums.

And what about Medicare? It is widely accepted, with 74 percent of doctors saying in a recent survey that they’re taking most or all new Medicare patients. But buying into Medicare won’t be cheap, about $7,600 a year not counting out-of-pocket costs for deductibles and copayments.

Ginsburg, the policy expert, says he’s puzzled as to why anyone in their late 50s would want to buy into Medicare instead of picking a plan offered in the new exchanges, the insurance supermarkets. His reasoning: The exchange plans should have lower premiums since they would also include younger people who don’t go to the doctor that often.

“The legislation already solved the problem by offering them coverage through the exchange,” he said. “A Medicare buy-in based on the older age group is going to cost a lot more.”

Tags: Access To Health Care, Barack Obama, Christmas, Government Programs, Government Regulations, Government-funded Health Insurance, Health Care Costs, Health Care Industry, Health Care Reform, Health Issues, Industry Regulation, North America, Personal Finance, Personal Insurance, Personal Spending, Political Issues, United States, Washington