Senate Democrats defeat GOP jobless aid bill as they struggle to advance their own

By APThursday, June 17, 2010

Senate defeats GOP jobless aid bill

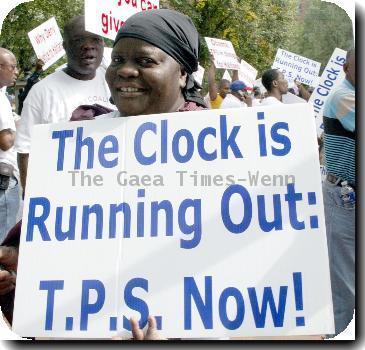

WASHINGTON — Senate Democrats on Thursday easily turned back a Republican effort to cut money from President Barack Obama’s stimulus package and other government spending to pay for an extension in unemployment benefits and aid to doctors.

Republicans were on the losing end of a 57-41 vote on the measure, which would have cut stimulus dollars and other spending to finance a six-month extension of unemployment checks for people who’ve been out of work for more than six months.

The vote came as Senate Democratic leaders tried to shore up support for a scaled-back version of their jobless aid bill, which would renew parts of last year’s economic stimulus measure. The catchall bill combines jobless aid for the long-term unemployed, help to cash-strapped state governments and the renewal of dozens of popular tax breaks for businesses and individuals.

Governors have complained that without additional state aid, hundreds of thousands of public employees and teachers will be laid off. Nevertheless, the measure failed to muster even a majority in a test vote Wednesday, falling far short of the 60 votes necessary to break a Republican filibuster.

The new version of the bill would add $55 billion to the deficit over the next decade, according to a Congressional Budget Office estimate.

“It’s moving in the right direction but it’s not there yet,” said Sen. Susan Collins of Maine, a key GOP vote sought by Democrats.

House Democrats, meanwhile, looked to increase lending by small banks as a way to resuscitate their election-year jobs agenda.

They’re on track to pass separate legislation designed to increase small business lending and investment. A bill creating a $30 billion fund for community banks to increase lending to small businesses is up for a possible vote in the House on Thursday.

Congressional Democrats started the year with an aggressive agenda of passing a series of bills designed to create jobs. Many of the proposals stalled as lawmakers, after hearing from angry voters, became wary of adding to the national debt, which stands at $13 trillion.

Democrats emphasized that the small business lending bill would not add to the debt. They estimate that banks will use the fund to leverage up to $300 billion in loans to small businesses.

Banks that tap the fund would issue preferred stock to the Treasury Department, paying dividends based on how much they increase lending to small businesses. The more they lend, the lower the payments. The stock would have to be redeemed within 10 years.

“Changing the tight lending standards have been one of the biggest appeals that we have had from the small business community,” House Speaker Nancy Pelosi, D-Calif., said.

The lending bill would provide $2 billion to assist states in their efforts to increase loans to small businesses. It would also authorize the Small Business Administration to match up to $1 billion in private investment in small startups.

“In a world where revolutionary new products are conceived in dorm rooms and companies are started in garages, we need new ways of meeting businesses’ capital needs,” said Rep. Nydia M. Velazquez, D-N.Y., chairwoman of the House Committee on Small Business.

Republicans said the package would do little to increase lending.

“The fact of the matter is, if government would just get out of the way, small businesses would lead us back to recovery,” said Rep. Sam Graves, R-Mo.

Rep. Virginia Foxx, R-N.C., said, “It’s really just another bank bailout.”

If the bill is passed, it would be merged with a package of tax breaks to encourage investment in small businesses that passed the House on Tuesday.

The tax package would provide about $3.6 billion in tax breaks over the next decade. Long-term investors in some small businesses would escape capital gains taxes. New small businesses could take larger tax deductions for startup expenses.

The bill includes tax increases that would offset the tax cuts and pay for the lending bill.

Tags: Barack Obama, North America, Political Organizations, Political Parties, Products And Services, Small Business, Small Business Financing, United States, Washington