Euro down sharply as banking concerns resurface after Spanish bank rescue

By Pan Pylas, APMonday, May 24, 2010

Euro down sharply as banking concerns resurface

LONDON — The euro dropped sharply Monday after the weekend’s de facto nationalization of a regional bank in Spain reignited fears about the continent’s debt crisis.

By late afternoon London time, the euro was down 1.4 percent at $1.2373.

By early afternoon London time, the euro was down 1.3 percent at $1.2378.

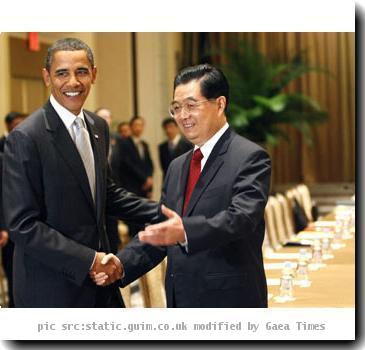

Allowing the Chinese yuan to rise against the dollar would make Chinese goods more expensive for American consumers but also cut the price of U.S. products sold in China. The yuan has been frozen in value against the dollar since mid-2008, a relationship American manufacturers blame for contributing to America’s huge trade deficits with China, the largest with any country.

The administration seeking to calm rising political anger in the United States about high unemployment, had been pressuring the Chinese to allow further appreciation in the yuan as a way of boosting U.S. exports. But private analysts said that change has grown far less likely in recent weeks as the dollar has strengthened against the euro.

The dollar is now 14 percent stronger against the euro since the beginning of this year. Since the yuan is tied to the dollar, that means the yuan is 14 percent stronger against the euro as well, making China’s exports less competitive in Europe. China’s largest bilateral trading relationship is with Europe.

“Europe is a major destination for Chinese exports. I am sure the Chinese government is already worried about the change in the yuan’s value against the euro,” said Sung Won Sohn, an economics professor at the Smith School of Business at California State University. “Whatever time frame they might have been considering for a move in the dollar-yuan exchange rate has been stretched out.”

The rescue of CajaSur follows last week’s decision by the Bank of Italy to suspend mark to market requirements on Italian bank exposure to eurozone government bonds, which fueled fears that an Italian bank may be in trouble.

“Hu is saying, ‘Don’t call us, we will call you,’ ” said David Wyss, chief economist at Standard & Poor’s.

The Bank of Spain recently estimated that the exposure of the Spanish banking sector to property is around €445 billion, which is equivalent to 42 percent of the value of the Spanish economy.

“This makes Spain vulnerable to a loss of foreign investor confidence given the large amount of bank debt that they hold,” said Jacques Cailloux, chief eurozone economist at the Royal Bank of Scotland.

Cailloux estimates that there is around €2 trillion of debt issued by public and private sector institutions from Greece, Spain and Portugal held by financial institutions outside these countries, or the equivalent of 22 percent of the eurozone’s gross domestic product — in the case of Spain, most of the liabilities are from the private sector, in contrast to Greece where the bulk is government-related.

Cailloux reckons the size of these liabilities requires measures to prevent a complete collapse in confidence, and has recommended that the European Central Bank steps up “considerably” its program of buying financial assets from the banks.

“We anticipate that the ECB will end up purchasing more private debt paper than sovereign debt,” said Cailloux.

Private sector difficulties are a headache the euro could do without — nevertheless, despite Monday’s sharp fall, Europe’s single currency is still way up from the four-year low of $1.2146 recorded last Wednesday in the wake of Germany’s shock decision to ban naked short-selling.

Elsewhere in the currency markets, the British pound dropped 0.4 percent to $1.4409 despite a package of spending cuts from the new coalition government, while the dollar was trading 0.1 percent lower at 90.08 yen.

Tags: Asia, China, Dollar, East Asia, England, Europe, Greater China, Hu Jintao, Italy, London, Lost, New York, North America, Recessions And Depressions, Southeast Asia, Spain, United Kingdom, United States, Western Europe