Unions push Senate Democrats to drop tax on high-cost health insurance plan

By Erica Werner, APThursday, December 10, 2009

Unions pressure Democrats on health insurance tax

WASHINGTON — Union leaders, among the most passionate backers of President Barack Obama’s health care overhaul, pressed Democratic senators Thursday to drop a tax on high-value insurance plans to pay for remaking the nation’s system.

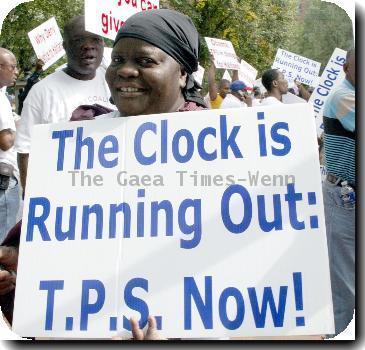

Members of several labor unions denounced the proposed tax on so-called “Cadillac plans,” arguing it wouldn’t just hit CEOs but also middle-class Americans who did without salary increases to negotiate better health benefits.

“I support health care reform but I can’t afford this tax,” Valerie Castle Stanley, an AT&T call center worker and member of the Communications Workers of America, said at a news conference outside the Capitol. “For families like mine that are on a budget, the results will be devastating.”

The Senate has been debating the health care bill since the beginning of last week but temporarily stopped Thursday afternoon to take up an unrelated spending bill. Debate on the health bill is expected to resume Monday.

At issue for the labor unions is a proposed 40 percent excise tax on insurance companies, keyed to premiums paid on health care plans costing more than $8,500 annually for individuals and $23,000 for families. The tax would raise some $150 billion over 10 years to help pay for the Democrats’ nearly $1 trillion health care bill. The legislation, which appears to be edging closer to passage, would revamp the U.S. health care system with new requirements on individuals and employers designed to extend health coverage to more than 30 million uninsured Americans.

The threshold for insurance plans that would be taxed had been adjusted higher in response to union members’ concerns, and Sen. John Kerry, D-Mass., a leader of those efforts, has said there could be further changes. But labor organizations including the Teamsters, the AFL-CIO and the National Education Association are urging the Senate to drop the tax entirely and take the approach embraced by the House, which would raise income taxes on individuals making more than $500,000 a year and couples making more than $1 million.

Union leaders have brought hundreds of members to the Capitol this week to lobby lawmakers.

“We should tax the millionaires, not teachers and bus drivers,” said Lily Eskelsen, vice president of the National Education Association.

Sen. Bernie Sanders, I-Vt., who spoke at Thursday’s news conference, has authored an amendment with Sen. Sherrod Brown, D-Ohio, to strip out the insurance plan tax, but doesn’t yet have agreement from Senate leaders to offer it. A number of Senate Democrats and White House officials support the insurance plan tax because they believe it would help hold down health care costs by providing an incentive for companies and workers to spend less on health care packages.

On the Senate floor Thursday, Sens. Byron Dorgan, D-N.D., and John McCain, R-Ariz., pushed an amendment to allow U.S. pharmacies and drug wholesalers to import Food and Drug Administration-approved drugs from Canada, Europe and a few other countries. It was unclear when a vote would take place, and people on both sides of the issue said it will be tough for supporters to get the 60 votes they’ll need to win.

As a candidate, Obama supported allowing U.S. consumers to order lower-cost prescriptions from abroad. As president, he needs the backing of the drug industry to push his health care bill through Congress. While administration officials contend the president still agrees in principle, the FDA is saying it would be difficult to fully guarantee the safety of imports, lending weight to the industry’s main argument.

The most crucial work on the overall bill was being done behind closed doors, where Senate Majority Leader Harry Reid, D-Nev., and his lieutenants were hunting support for a tentative deal among moderate and liberal Democrats to expand the government’s role in providing care.

In a bow to a crucial bloc of liberals, the compromise drops a full-blown government health plan that’s a top priority for liberals. Instead, the same federal agency that negotiates health insurance for federal workers and members of Congress — the Office of Personnel Management — would administer national, nonprofit plans available to the public.

In addition, Medicare, currently for those age 65 and up, would be offered to people who are at least 55 and wished to purchase coverage. That provision could guarantee that Democrats won’t get the support of moderate Sen. Olympia Snowe, R-Maine, the only Senate Republican to support the Democratic health care bill in committee. Snowe said Thursday that expanding Medicare is “the wrong direction to take,” citing concerns that the program’s payment rates, which are low compared to private insurers, would hurt providers such as hospitals and doctors.

Snowe’s vote has been heavily courted by Democrats — who need the support of every member of their 60-vote caucus to pass the health bill — and she met with Obama Wednesday at the White House. Reid was asked at a news conference Thursday if he was confident he would have the votes to prevail without her, and said: “We’ll find out when we have the vote but I’m feeling pretty confident today.”

Moderate Sens. Ben Nelson, D-Neb., and Bob Casey, D-Pa., said they were exploring possibilities for compromise language on abortion after the failure of an amendment Nelson offered to put strict restrictions on federal funding of abortion.

Associated Press writers Alan Fram and Sam Hananel contributed to this report.

Tags: Access To Health Care, Barack Obama, Education, Government Programs, Government Regulations, Government-funded Health Insurance, Health Care Costs, Health Care Industry, Health Care Reform, Health Issues, Industry Regulation, John Kerry, Labor Issues, North America, Personal Finance, Personal Insurance, Personnel, Political Issues, Political Organizations, Political Parties, Products And Services, Teaching, United States, Washington