BP shares open 6.5 percent higher in London after agreement with US to set up oil spill fund

By APThursday, June 17, 2010

BP shares higher on oil spill fund deal

LONDON — Shares in BP rose in London Thursday, as the company’s agreement to set up a $20 billion fund and cancel dividend payments to cover damage from the Gulf of Mexico oil spill was seen as reducing uncertainty over its liabilities.

Some analysts had a “buy” rating on the stock despite the risks to the company from the spill.

The shares were up 6.9 percent at 360.15 pence ($5.34) midday trading on the London Stock Exchange, retreating from an earlier peak of nearly 370 pence.

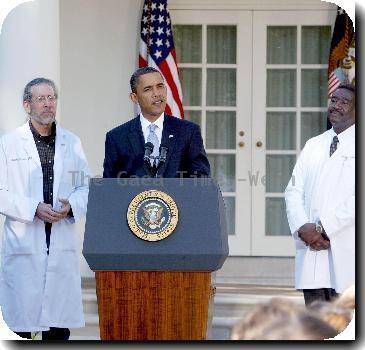

They had also rallied in U.S. trading Wednesday, gaining 45 cents to close at $31.85, after BP executives’ meeting with President Barack Obama produced an agreement that analysts said provided much-needed clarity for investors. Pension funds, which hold major stakes in BP, were unhappy at the suspension of dividends.

“BP’s package agreed with President Obama should cool the political heat and provide some degree of comfort to equity and bond markets, shareholders and businesses/residents in (the Gulf of Mexico) affected by the Deepwater Horizon accident,” analysts at Evolution Securities said in a research note Thursday.

“Even if the final cost totals $40 billion and BP is liable for 100 percent the shares look oversold,” said the analysts, who recommend the shares as “buy.”

Analysts at Collins Stewart in London also upgraded their recommendation to “buy.”

“We recognize that some investors may prefer not to hold BP at all for the next several months because of environmental concerns or social conscience issues, and we fully acknowledge that the risks on the stock remain high,” they added in a research note.

BP PLC’s shares have lost nearly half of their value — paring the company’s market value to $90 billion — since the April 20 explosion on the Deepwater Horizon rig which killed 11 workers and sent oil gushing from a broken pipe.

Hannah Williams of Datamonitor financial analysts, said the dividend announcement was bad news for pension funds and individual investors.

“One-seventh of dividend income from FTSE-100 companies comes from BP, with a large majority of BP shareholders being U.K. pension funds. Therefore the dividend payments which are worth a total of 1.8 billion pounds every three months will further impact these funds which have already been affected by a halving of BP share value,” Williams said.

BP Chief Executive Tony Hayward faced another uncomfortable day on Thursday when he appears before a Congressional committee investigating the disaster.

In prepared testimony obtained by The Associated Press, Hayward said the explosion and sinking of the BP-operated rig “never should have happened — and I am deeply sorry that they did.”

Britain’s Treasury chief, George Osborne, said he was confident that BP would weather the crisis.

“I think BP in the end is a very strong company,” Osborne said in a BBC radio interview Thursday.

“BP have set aside a pretty considerable sum of money but they have these resources. This is a very important company, not just to the British economy but to the American economy as well, and we want it to succeed and flourish for all our sakes,” Osborne said.

Tags: Barack Obama, Debt And Bond Markets, Dividends, England, Europe, Gulf, London, North America, Oil spill, Personnel, United Kingdom, United States, Western Europe