THE INFLUENCE GAME: Lobbying pays off as drug industry hits jackpot with health overhaul.

By Alan Fram, APMonday, March 29, 2010

THE INFLUENCE GAME: Drug lobby’s health care win

WASHINGTON — Chalk one up for the pharmaceutical lobby.

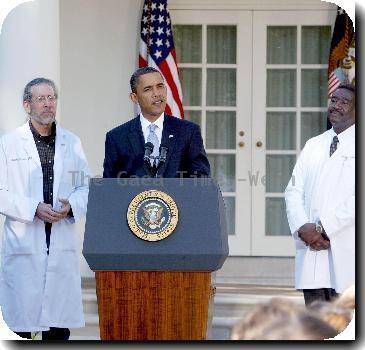

The U.S. drug industry fended off price curbs and other hefty restrictions in President Barack Obama’s health care law even as it prepares for plenty of new business when an estimated 32 million uninsured Americans gain health coverage.

To be sure, the law also levies taxes and imposes other costs on pharmaceutical companies, leaving its final impact on the industry’s bottom line uncertain. A recent analysis by Goldman Sachs, the Wall Street firm, suggests the overhaul could mean “a manageable hit” of tens of billions of dollars over the coming decade while bolstering the value of drug-company stocks. Others expect profits, not losses, of the same magnitude.

Either way, pharmaceutical lobbyists won new federal policies they coveted and set a trajectory for long-term industry growth. Privately, several of them say their biggest triumph was heading off Democrats led by Rep. Henry Waxman, D-Calif., who wanted even more money from their industry to finance the health care system’s expansion.

“Pharma came out of this better than anyone else,” said Ramsey Baghdadi, a Washington health policy analyst who projects a $30 billion, 10-year net gain for the industry. “I don’t see how they could have done much better.”

Costly brand-name biotech drugs won 12 years of protection against cheaper generic competitors, a boon for products that comprise 15 percent of pharmaceutical sales. The industry will have to provide 50 percent discounts beginning next year to Medicare beneficiaries in the “doughnut hole” gap in pharmaceutical coverage, but those price cuts plus gradually rising federal subsidies will mean more elderly people will purchase more drugs.

Lobbyists beat back proposals to allow importation of low-cost medicines and to have Medicare negotiate drug prices with companies. They also defeated efforts to require more industry rebates for the 9 million beneficiaries of both Medicare and Medicaid, and to bar brand-name drugmakers’ payments to generic companies to delay the marketing of competitor products.

The impressive list of wins is testament to a carefully planned and well-financed lobbying strategy, led by Pharmaceutical Research and Manufacturers of America, the industry’s deep-pocketed trade group.

The trade group has been led by Billy Tauzin, whose $4.5 million in earnings in 2008, the most recent figure available, underscore the high stakes for the industry.

The former Louisiana congressman will quit his post in June — a decision he abruptly announced in February when it seemed the health bill would die. Some industry officials said at the time that Tauzin was forced out, which the trade group denied.

As Obama’s health care drive began last year, drugmakers agreed with Senate Finance Committee Chairman Max Baucus, D-Mont., and White House officials to support the effort. In exchange, the companies volunteered $80 billion in 10-year savings for the health care changes, and backed it up with an expensive TV ad campaign pushing Obama’s proposal.

It is unclear precisely how much drug manufacturers ended up contributing, in part because much of the savings — like discounts to seniors — come off prices the companies themselves set. Their biggest expenses over the decade are estimated to include over $20 billion for an expanded rebate for medicines used by Medicaid, $28 billion for a new fee on drug firms and about $30 billion for closing the “doughnut hole.”

In a March 21 newsletter, the financial services firm Morgan Stanley estimated a $95 billion, 10-year price tag, offset by tens of billions the companies would gain from extra customers and other provisions. Industry critics say the cost will be lower because of firms’ control of prices, and will be more than outweighed by added sales.

Yet even the worst-case scenario — a net cost of tens of billions — would be small for a U.S. drug industry that IMS Health, a medical data firm, calculates earns more than $300 billion a year.

“Let’s put it this way: They can afford it,” said Tim Chiang, a pharmaceutical analyst in Stamford, Conn.

Drugmakers gained an eleventh-hour win when lawmakers decided against expanding drug discounts to some hospitals serving low-income patients, a proposal some feared could cost tens of billions. The overhaul law that Obama signed Tuesday would have broadened those discounts to inpatients, but the companion bill revising the earlier measure largely pulled that back.

Senate Finance Committee Chairman Baucus, said in an interview last week that as a trade-off for rolling back that expansion, the drug industry agreed to provide an additional $10 billion over a decade to help close the gap in Medicare coverage.

As for what Democrats gained from their ally, the industry and coalitions it joined spent about $67 million on supportive TV ads since the beginning of 2009, according to Evan Tracey, president of Kantar CMAG, which tracks political ads. That made it one of the biggest players in an airwaves battle that saw all sides spend $220 million.

Pharmaceutical interests spent $188 million lobbying last year, more than all but a handful of industry sectors, according to the nonpartisan Center for Responsive Politics. They employed an army of 1,105 lobbyists.

And after years of funneling most of its campaign contributions to Republicans, the industry has favored Democrats with 56 percent of the $5 million it has handed candidates so far this year. The biggest recipient, by far, of the industry’s 2008 election cycle contributions of $13.8 million was Obama, who received $1.2 million for his presidential campaign.

“They’re certainly going to get a very high return on that investment,” Waxman said in a recent interview.

Tags: Barack Obama, Campaigns, Diagnosis And Treatment, Government Programs, Government Regulations, Government-funded Health Insurance, Health Care Costs, Health Care Industry, Health Issues, Industry Regulation, Medication, North America, Personal Finance, Personal Insurance, Political Fundraising, Sports, Stakes, United States, Washington